Life Insurance in and around Littleton

State Farm can help insure you and your loved ones

Life happens. Don't wait.

Would you like to create a personalized life quote?

- Littleton

- Roxborough

- Sterling Ranch

- Ravenna

- Sedalia

- Highlands Ranch

- Ken Caryl

- Arrowhead

- Colorado

- Waterton Canyon

- Lockheed

- Roxborough Park

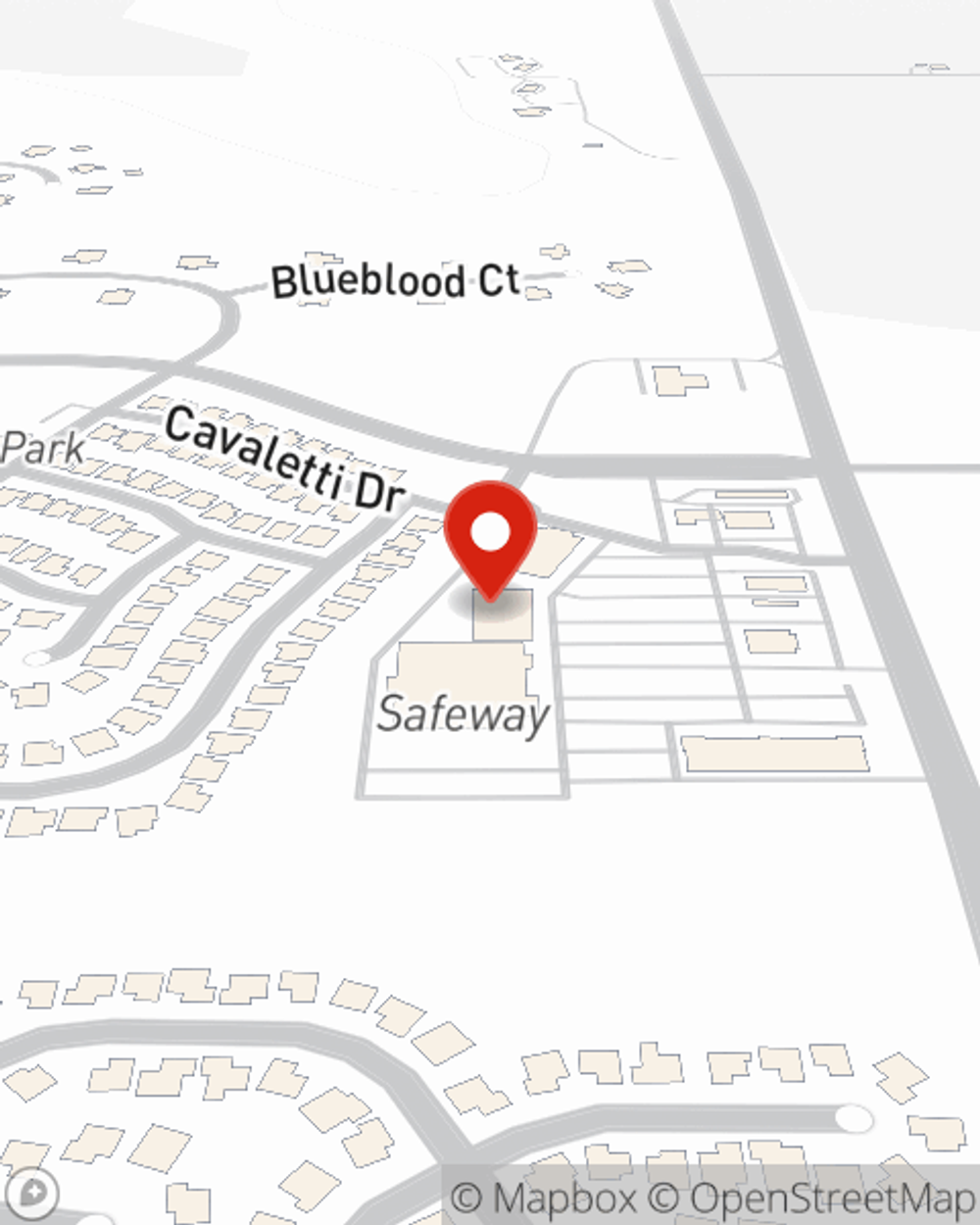

- Safeway Center

- Louviers

- Chatfield

- Wadsworth

- Rampart Range

- Trailmark

- Ascent Village

- Prospect Village

- Waterton

- Plum Creek

- Titan

- Chatfield Farms

It's Never Too Soon For Life Insurance

When you're young and your life ahead of you, you may think you don't need Life insurance. But it's a great time to start thinking about Life insurance to prepare for the unexpected.

State Farm can help insure you and your loved ones

Life happens. Don't wait.

State Farm Can Help You Rest Easy

One of the ideal times to get Life insurance can be when you're just starting out. Whether you decide to go with level or flexible payments with coverage to last a lifetime coverage for a specific time frame or another coverage option, State Farm agent Joseph Magoffin can help you with a policy that can help cover your loved ones.

If you're a person, life insurance is for you. Agent Joseph Magoffin would love to help you check out the variety of coverage options that State Farm offers and help you get a policy that's right for you and the ones you love most. Reach out to Joseph Magoffin's office to get started.

Have More Questions About Life Insurance?

Call Joseph at (720) 639-3950 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

How to use life insurance to help a special needs child or adult

How to use life insurance to help a special needs child or adult

From life insurance to a special needs trust, here's what you need to know to keep your loved one financially secure.

Joseph Magoffin

State Farm® Insurance AgentSimple Insights®

How to use life insurance to help a special needs child or adult

How to use life insurance to help a special needs child or adult

From life insurance to a special needs trust, here's what you need to know to keep your loved one financially secure.